Introduction: Embarking on the Journey to Preferred Provider Status

In the labyrinthine world of healthcare, securing preferred provider status with insurance companies is a formidable yet coveted goal. Preferred providers enjoy a competitive edge in patient referrals and financial rewards, while patients benefit from reduced out-of-pocket expenses and access to renowned medical expertise. Understanding the intricate process involved in becoming a preferred provider is crucial for any healthcare professional seeking growth and excellence.

Image: www.slideserve.com

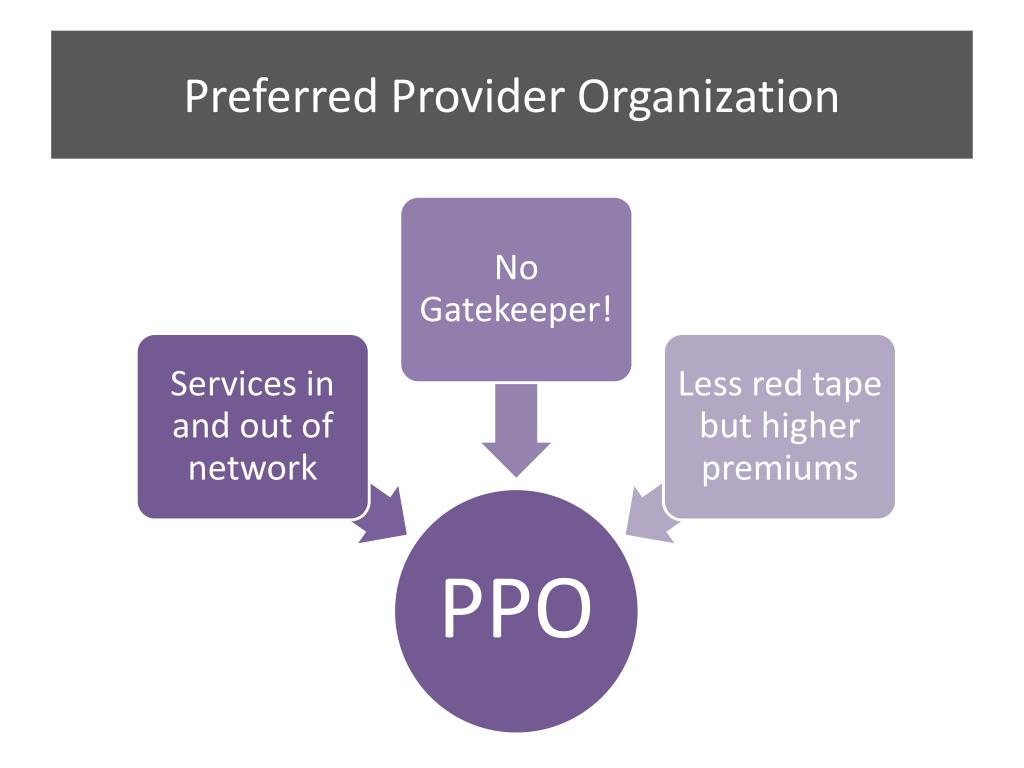

Unveiling the Preferred Provider Landscape

A preferred provider, also known as an in-network provider, is a healthcare practitioner or facility that has negotiated a contractual agreement with an insurance company. These agreements stipulate the fees the provider may charge for specific services, ensuring patients pay reduced costs when seeking care. Insurance companies maintain curated networks of preferred providers to offer their members access to high-quality, cost-effective healthcare services.

The Cornerstones of Preferred Provider Designation

The path to becoming a preferred provider involves navigating a rigorous set of criteria established by insurance companies. These criteria typically encompass the following:

-

Licensing and Accreditation: Demonstrating adherence to industry standards and ethical practices through relevant licensing and accreditations.

-

Peer Evaluation: Undergoing comprehensive peer reviews to assess the quality and appropriateness of medical care provided.

-

Patient Outcomes: Delivering exceptional patient care, resulting in favorable patient satisfaction ratings and improved health outcomes.

-

Financial Stability: Maintaining a sound financial track record to ensure timely and accurate billing practices.

-

Provider Scope: Aligning the provider’s scope of practice with the insurance company’s coverage offerings.

Building a Strong Case: Crafting a Compelling Application

To initiate the process of becoming a preferred provider, healthcare professionals must submit an application to the insurance company they wish to partner with. This application should meticulously outline the provider’s qualifications, including:

-

Detailed curriculum vitae showcasing education, experience, and certifications.

-

Proof of current licensing, board certifications, and malpractice insurance.

-

Patient satisfaction surveys and testimonials.

-

A comprehensive business plan outlining financial projections and growth strategies.

Image: studylib.net

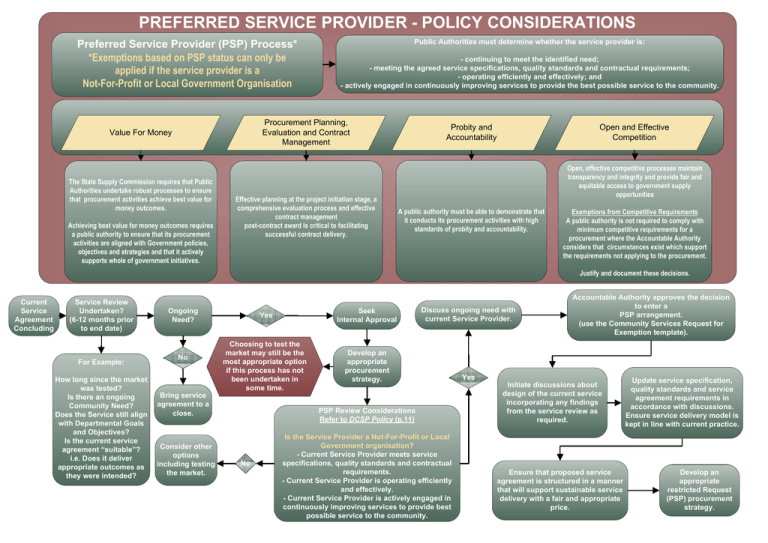

The Journey to Preferred Providerhood: A Step-by-Step Guide

1. Research and Selection: Identify insurance companies that align with your practice’s specialty and patient population.

2. Application Submission: Submit a meticulously crafted application that demonstrates your commitment to high-quality healthcare and financial stability.

3. Review and Assessment: Insurance companies conduct a thorough review of the application, including peer evaluation and site visits.

4. Credentialing and Agreement: Complete the credentialing process and negotiate an agreement that outlines fees and services covered.

5. Marketing and Networking: Build relationships with insurance plan representatives and attend industry events to promote your preferred provider status.

6. Continuous Quality Improvement: Maintain and enhance clinical outcomes, patient satisfaction, and business operations to ensure ongoing compliance with preferred provider requirements.

The Perks and Privileges of Preferred Providerhood: Enhancing Your Practice

-

Increased Patient Referrals: Benefit from increased patient referrals from insurance companies who recommend your services to their members.

-

Enhanced Financial Stability: Secure competitive reimbursement rates and reduced collection hassles through in-network agreements.

-

Patient Convenience: Offer reduced out-of-pocket expenses to patients, increasing their access to quality healthcare.

-

Improved Market Positioning: Establish your practice as a provider of exceptional care, garnering trust and recognition within the healthcare industry.

Expert Insights: Navigating the Preferred Provider Landscape

“Becoming a preferred provider requires a commitment to excellence, both clinically and administratively,” advises Dr. Emily Carter, a renowned orthopedic surgeon. “Continuously evaluating and improving your practice will not only enhance patient outcomes but also strengthen your position as a preferred provider.”

Mark Richards, VP of Network Development at a leading health insurer, shares his perspective: “Insurance companies seek preferred providers who prioritize patient-centric care while maintaining ethical and financial integrity. Transparency and strong communication are key to building lasting partnerships.”

How To Become A Preferred Provider For Insurance Companies

The Heart of the Matter: Unlocking the Power of Empathy and Partnership

Becoming a preferred provider is not merely a clinical or financial exercise but a testament to the profound connection between healthcare providers and insurance companies. Both parties share a noble mission: to enhance patient health and well-being. The journey towards preferred providerhood requires empathy, transparency, and a collaborative spirit, ensuring that every patient has access to the care they deserve. By forging these partnerships, healthcare providers and insurance companies can create a healthcare system where excellence prevails and patients thrive.